The company will typically send you a cash advance for a portion of the total purchase within a couple of days-usually around 80-85%. If you agree to their terms, the invoice factoring company will pay you a total of $9,700 for the invoices and keep their 3% (aka $300). That company might then create an invoice factoring agreement with you and buy your accounts receivable for the value of the invoices, minus a fee of about 3%. You might find you have the capital you need in the form of outstanding invoices, in which case you can sell these to a factoring company. This means looking to accounts receivable to see what you’re owed - and then getting that money faster.

#Cash for outstanding invoices upgrade#

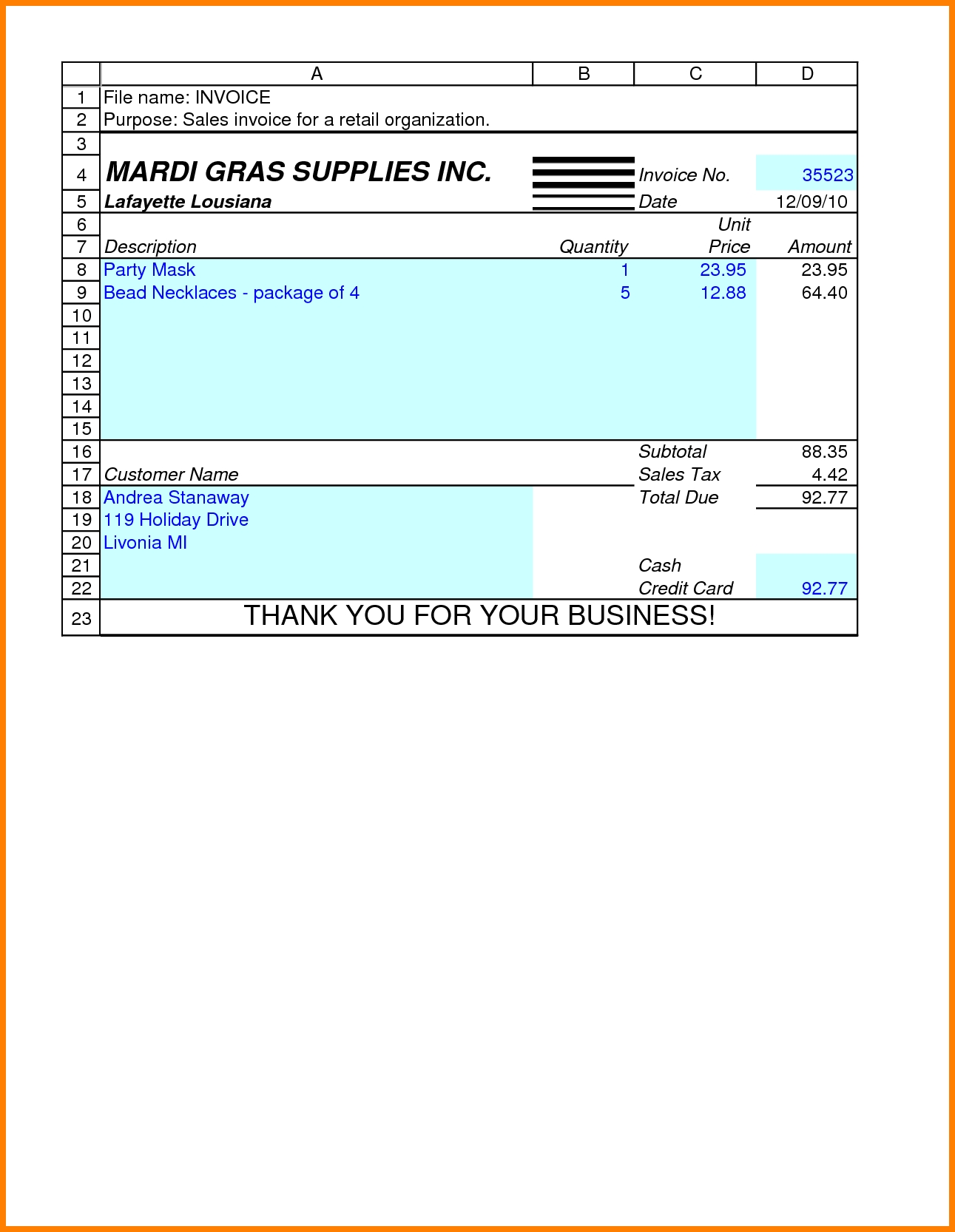

If your business needs $10,000 upfront to buy a new printer or upgrade software, but you don’t have the budget for this, you can try factoring invoices. Invoice factoring uses your outstanding invoices and turns them into immediate cash. Once settled, the factoring company pays the remaining amount to you.

They can then collect payment from customers within one to three months. When the factoring company purchases outstanding invoices from a business, they send a fraction of the invoice amount upfront. It consists of selling unpaid customer invoices to a third-party invoice factoring company. Invoice factoring is a type of financing that can help smaller businesses access cash quickly. We’ll cover the differences in more detail below, as well as everything else you need to know about the invoice factoring Vs. Invoice discounting consists of a loan, whereas invoice factoring is when a financial company purchases your invoices at a slightly discounted price. Invoice factoring and invoice discounting are two related but distinct financial methods for receiving funds for unpaid invoices upfront - I.e., before the client has paid you for services rendered.

0 kommentar(er)

0 kommentar(er)